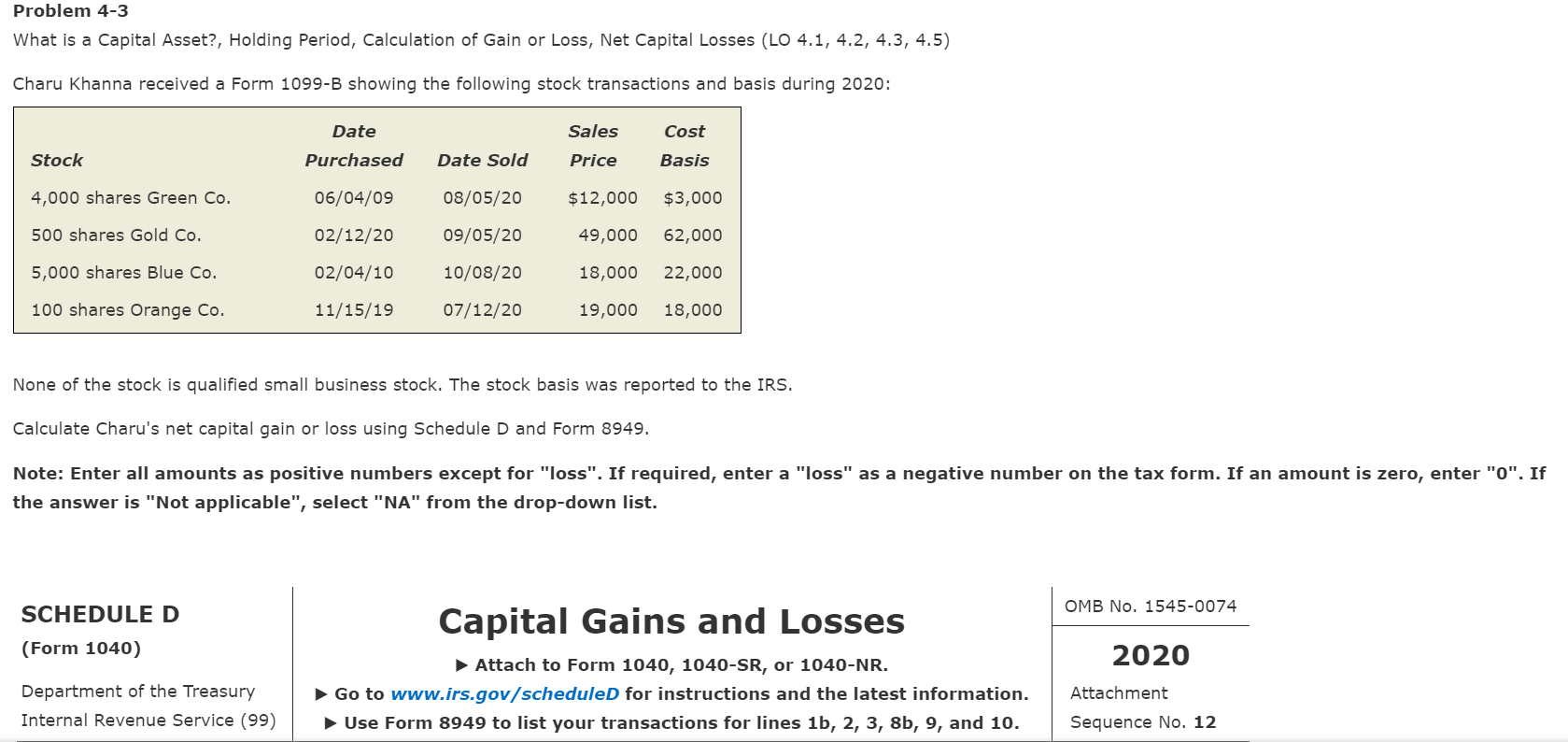

Buying your basic residence is a primary milestone, but there’s a lot to think ahead of getting in touch with your own a house broker. While the an initial time home consumer, just be in a position to qualify for home financing dependent on your credit history, money, downpayment, and amount of obligations. You also need to make sure you may be it’s in a position having homeownership and costs which go along with it, along with settlement costs, assets fees, and continuing repair expenditures.

When you’re to get property the very first time, so it first-day homebuyers publication will help you to make sure you will be making best choice. You will understand exactly how you have made recognized to possess a home loan; first-date family consumer apps you might benefit from; home loans best for basic-go out buyers; and you will key factors to take on before you make your purchase.

Your ability to help you be eligible for home financing utilizes the credit history, debt-to-earnings ratio, a position records, therefore the quantity of the down payment.

Government-supported fund, plus loans secured by the Pros Government (VA), Government Houses Administration (FHA), and you may You.S. Service out-of Agriculture (USDA) tend to have easier qualifying standards than antique money, which aren’t guaranteed by the people bodies agencies.

Credit score

Lowest credit history requirements are very different from the bank to own conventional financing. Top credit rating habits work on a measure https://paydayloanalabama.com/eva/ away from 3 hundred so you can 850, and you can countless 740 or above are thought are most an excellent otherwise excellent.

Essentially, probab observe a score with a minimum of 620, which is noticed a reasonable credit score. To qualify for loans at the most aggressive costs, you might you desire a score of around 740 or even more.

- The minimum rating you might need having an FHA mortgage is actually 500 if one makes a ten% down-payment or 580 having an excellent step three.5% deposit. Below are a few our very own better FHA loan providers here.

- Va funds don’t have the absolute minimum credit rating, but the majority of loan providers like to see a rating away from 620 or high. Here are some our very own most readily useful Virtual assistant fund here.

- The latest USDA does not put at least credit history, however, loan providers will favor a score away from 640 or maybe more. Better USDA loan lenders is obtainable here.

Debt-to-income ratio

Lenders need to make yes you have got adequate money so you’re able to shell out the mortgage loan. To choose which, they appear in the one another your earnings along with your number of debt. There are in fact a few other loans-to-earnings rates they envision:

- Their front-stop proportion: This will be determined by evaluating your revenue to your financial costs (including principal, focus, fees, and you will insurance). If the financial will cost you overall $900 30 days along with your pre-tax income totals $5,100, their top-avoid proportion would be 18% ($900 separated of the $5,000). Most traditional loan providers want to see a front-stop proportion regarding no more than twenty eight% though some lenders try versatile and Va, FHA, and you will USDA financing allow for increased proportion.

- The back-avoid ratio: So it proportion is actually computed by comparing complete obligations can cost you so you’re able to money. Some obligations costs that will be taken into account include your own homeloan payment, car and truck loans, college loans, and you can personal credit card debt. Power costs, automobile insurance, and you will specific other monthly obligations not said so you can major credit reporting organizations aren’t noticed. Generally, lenders like this proportion is below 43% though some has actually stricter percentages. You might be capable qualify for Va, FHA, and USDA money with increased debt in line with income.

A career records

Loan providers need to know your own revenue stream are a constant one to. This means that, for antique and you can FHA Fund, you will need to amuse money might have been steady across the earlier in the day two years. Tax statements, spend stubs, W-2s and 1099s can all be regularly show that you’ve got a frequent earnings. When you find yourself there was a lot more self-reliance with Va and you can USDA loans, very lenders often nevertheless require you to tell you you has worked continuously.